Economic Affairs, Vol. 65, No. 2, pp. 209-216, June 2020

DOI: 10.46852/0424-2513.2.2020.15

An Economic Analysis of Paddy Value Chain in Thanjavur District of Tamil Nadu

ABSTRACT

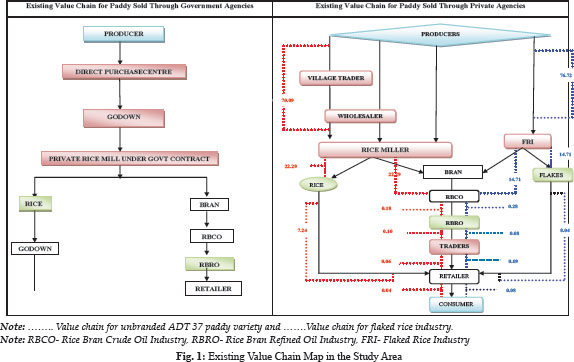

In view of the economic importance of value addition the present study was taken up in Thanjavur district of Tamil Nadu, India to estimate value chain of paddy. The aim of the study is to identify the existing value chain and create new chain in the study area. Random sampling technique was used to select 60 farmers. The result showed that, the recovery of main and by product during rice milling was 60 per cent of rice, 10 per cent of broken rice, 15 per cent of rice bran, 10 per cent of husk and 5 per cent waste from one tonne of paddy. In value chain for rice production, the share in value addition was 26.42 per cent for rice millers, 0.16 per cent Rice bran crude oil, 0.09 per cent for Rice bran refined oil, 0.05 per cent for traders, 6.41 per cent rice retailers and 0.04 per cent for rice bran refined oil retailers. In value chain for flaked rice industry, the share in value addition was 14.71, 0.28, 0.08, 0.09, 8.04 and 0.08 per cent for Flaked Rice Industry, Rice Bran Crude Oil, Rice Bran Refined Oil, traders, flaked rice retailers and rice bran refined oil retailers in channel respectively. Finally the study concluded that, the value addition in the existing value chain was 5096 which can be increased to 9530 through proposed model.

Highlights

The long marketing channel which includes more intermediaries and less value addition at farmer level results in low profit to the farmers. Developing a good value chain for rice which will benefit all the stake holders in rice value chain is the need of present hour.

The long marketing channel which includes more intermediaries and less value addition at farmer level results in low profit to the farmers. Developing a good value chain for rice which will benefit all the stake holders in rice value chain is the need of present hour.

Keywords: Value chain, rice, flaked rice, by products of paddy

Rice is one of the most important staple food crops in the world. Over 50 per cent of the world population depends on rice for their 80 per cent of the food requirements. Rice contributes 43 per cent of total food grains production and it provides 21 per cent of global human per capita energy and 15 per cent of per capita protein requirement (source (FAO, 2019). Rice is produced all over the world particularly in South East Asian region, which plays a significant role in both production as well as consumption. According to Food and Agricultural Organization (FAO, 2019), the country's rice area and production were 44 million hectares and 117.47 million tonnes respectively. The average rice productivity in India was found to be 2576 kg per hectare during 2018-19. Major Rice growing states in India are West Bengal, Uttar Pradesh, Andhra Pradesh, Punjab, Bihar, Orissa, Chhattisgarh, Assam and Tamil Nadu. Rice is the most important food crop in Tamil Nadu and it is grown in almost all the districts of the state. In 2017-18, the area under paddy cultivation in Tamil Nadu was 18.91 lakh hectares and the production was 66.38 lakh tones. The productivity of paddy in Tamil Nadu is 3630 kg per hectare. (Source: Season and Crop Report of Tamil Nadu, Government of Tamil Nadu 2017-18). The price of paddy is fixed on four major criteria namely moisture content (11-12%), recovery of rice, broken rice and black grains. Role of value chain is reducing inventories, wastage, costs and increase efficiency within the firm and market channel. Collaborative planning and information sharing practices will streamline the information flow in the value chain. A good value chain will provide superior value to the ultimate customer (Richard and Besigye, 2005). There are many value added products that is produced from paddy. The major products are Rice, Rice bran oil, Flaked rice, Rice flour, Rice milk, Rice pudding, Rice starch, Rice straw, Rice used in beverage making, Rice paper, Rice glue, Rice cakes (Mochi), Rice vinegar, Rice soy milk, Red yeast rice and other Rice based food products. This study will provide a clear picture on value addition, marketing efficiency etc, in the present rice marketing system. Value addition process and possibilities in each and every stage of marketing of rice from the farmer to consumer will be revealed. The result would help the farmers to cultivate consumer preferred rice varieties using modern technologies. The study would be helpful to the farmers to enhance their income and rice processing industries to manage their value chain effectively by minimizing the cost and increasing the efficiency and thereby enhance their profit. The rationality of value addition on rice, which satisfies the consumer needs, can be identified and the consumers would benefit through the quality product as they prefer. This study will be useful to the farmers and other stakeholders, researchers and policy makers.

How to cite this article: Nagarethinam, R. and Angles, S. (2020). An economic analysis of paddy value chain in Thanjavur district of Tamil Nadu. Economic Affairs, 65(2): 209-216.

Source of Support: None; Conflict of Interest: None

Specific Objectives

Data and Methodology

Thanjavur district (called as rice bowl of Tamil Nadu) is the major paddy producing district was selected for this study. From the district, two taluks were randomly selected (Thiruvaiyaru and Vallam taluks) and from each taluk three villages were selected at randomly. The farmers were contacted individually for collection of production and marketing details of paddy with the help of well structured and pre - tested interview schedule. The intermediaries involved in marketing of paddy namely village traders, wholesalers, retailers and processors were also interviewed for the study.

RESULTS AND DISCUSSION

General Characteristics of Sample Farmers

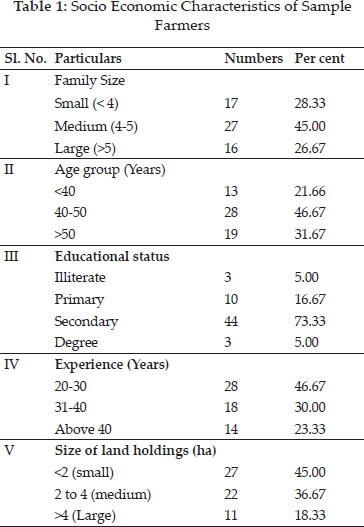

It was observed from Table 1 among the 60 sample farmers 45 per cent of farm house holds had medium size family with four to five persons per family, 46.47 per cent of the farmers were in the age group between 40 to 50 years, 73.33 per cent of farmers had only secondary level of education 46.67 per cent farmers had the experience of more than 20 to 30 years. Regarding size of land holding, 45 per cent farmers are small farmers having less than two hectares of land.

Cropping Pattern

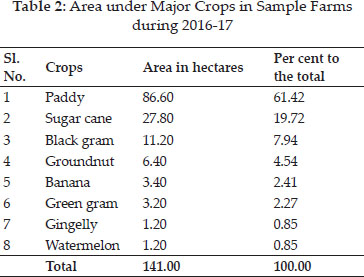

Cropping pattern observed in sample farms for the year 2016-17 is presented in Table 2. It clearly showed that in the study area major area was under paddy crop i.e. 61.42 per cent. This is mainly due to the environmental and climatic factors that were highly suitable to grow paddy crop. Next to paddy, sugar cane and black gram occupied the major area of 19.72 per cent and 7.94 per cent, respectively. Crops such as groundnut, gingelly, banana, watermelon and green gram were also grown in small areas.

Value Chain Analysis for Paddy Production

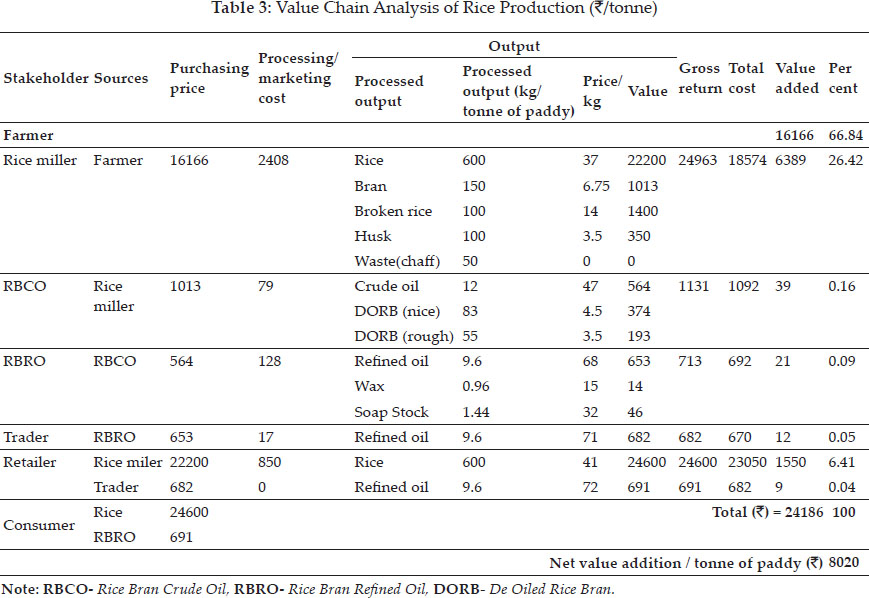

Table 3 shows the average price received by producer for paddy (without any value addition such as drying, storage and etc.) was ₹ 16166. Total cost incurred by rice miller was ₹ 2408 to produce 600 kgs of rice, 150 kgs of bran, 100 kgs broken rice and 100 kgs of husk from paddy. The value addition gained by rice miller was 26.42 per cent.

Rice bran crude oil industry processed 150 kgs of rice bran to produced 12, 83 and 55 kgs of rice bran crude oil, de oiled rice bran (nice) and de oiled rice bran (rough), respectively. The gross return received by rice bran crude oil industry was ₹ 1131. The net value addition gained by rice bran crude oil industry was 0.16 per cent.

The rice bran refined oil industry produced 9.6 kgs of rice bran refined oil, 0.96 kgs of wax and 1.44 soap stock from 12 kgs of rice bran crude oil. The gross return received by rice bran refined oil industry was ₹ 713 and average price paid by trader was ₹ 653. The average price paid by retailer was ₹ 682 and ₹ 22, 200 for rice bran refined oil and rice.

Value Chain Analysis for Flaked Rice Production

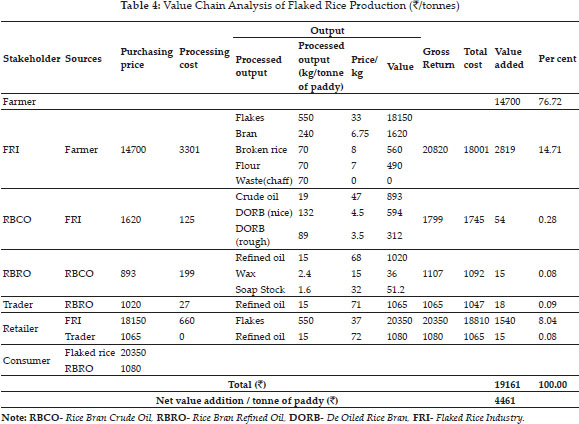

Table 4 presents the flaked rice processor produced 550 kgs of flaked rice, 240 kgs of bran, 70 kgs of broken rice, 70 kgs of flour and 70 kgs of waste from one tonne of paddy. The total cost incurred by flaked rice processor was ₹ 18,001, which included purchasing price of paddy. Gross return and value addition gained by flaked rice processor were ₹ 20,820 and ₹ 2819 (14.71 per cent) per tonne of paddy respectively. The average price paid by retailers was ₹ 18,150 for 550 kgs of flaked rice.

The rice bran crude oil industry produces 19 kgs, 132 kgs and 89 kgs of rice bran crude oil, de oiled rice bran (nice) and de oiled rice bran (rough) from 240 kgs of bran, respectively. The value addition gained by the rice bran crude oil industry was ₹ 54 with gross return of ₹ 1799. The rice bran refined oil industry produced 15 kgs of rice bran refined oil, 1.6 kgs of soap stock and 2.4 kgs of wax from 19 kgs of rice bran crude oil. The gross return received by rice bran refined oil industry was ₹ 1107 and value addition was ₹ 15 (0.08 per cent) per tonnes of paddy. The average price paid by trader was ₹ 1020 for 15 kgs of rice bran refined oil. The average price paid by retailer was ₹ 1065 for rice bran refined oil.

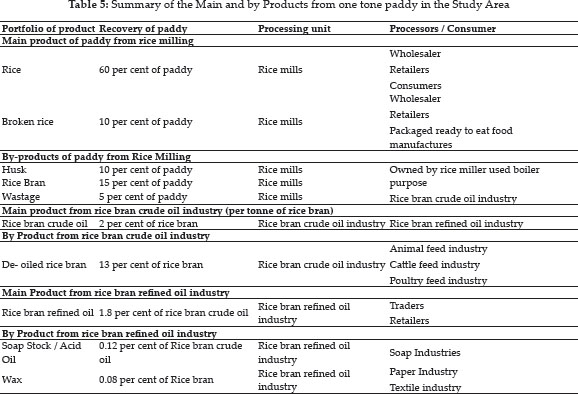

Main and By Products of Per Tonne Paddy

Table 5 shows the recovery of main and by products of paddy having various processing process. The recovery of main and by product during rice milling was 60 per cent of rice, 10 per cent of broken rice, 15 per cent of rice bran, 10 per cent of husk and 5 per cent waste from one tonne of paddy. The consumers of rice millers were wholesaler, retailer, ready to cook food manufactures and rice bran crude oil industries. From 15 per cent of rice bran, the rice bran crude oil industry produces 2 percent of rice bran crude oil and 13 per cent de oiled rice bran. The consumers of rice bran crude oil industry were rice bran refined oil industry, cattle feed industry, poultry feed industry and animal feed industries. Rice bran refined oil industry produced 1.8 per cent of rice bran refined oil, 0.08 per cent of wax and remaining 0.12 per cent was soap/ stock or acid oil from one tonne of rice bran crude oil. The consumers of rice bran oil industry were soap manufacturers, traders, retailer, paper industry, textile industry.

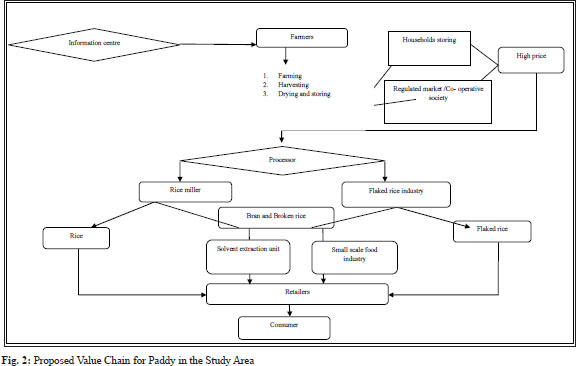

Proposed Value Chain for Paddy in the Study Area

The new value chain model emerged out of the study is presented in the Fig. 2. In the model various aspect of rice marketing, processing, value addition etc, was incorporated to add maximum value to the paddy and enhance the consumer satisfaction. In the model various stake holders from farmers to ultimate consumers were taking part. At each and every stage of paddy value chain value will be added in the model.

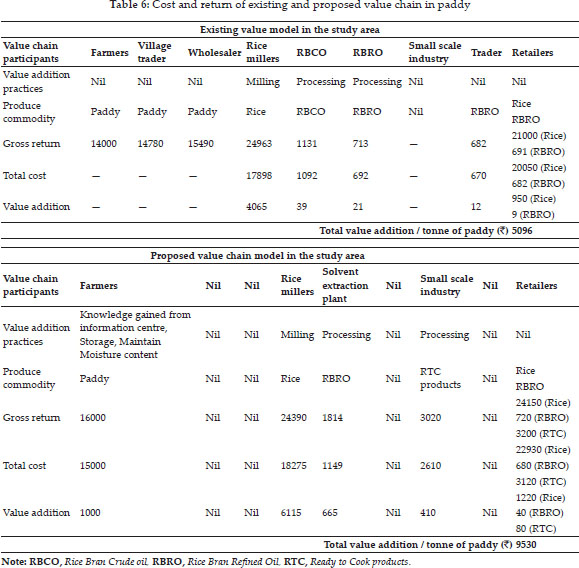

Advantages of Proposed Value Chain Model Over Existing Value Chain Model of Paddy

The cost and returns of existing and proposed value chain model is presented in Table 6. In comparison with the existing value chain in the proposed value chain model the village traders and wholesalers were eliminated. In rice milling due to increase in the recovery percentage the net value addition will be increased from ₹ 4064 in existing model to ₹ 6115 in proposed model. At present there are two processing industries for rice bran oil production such as rice bran crude oil industry and rice bran refined oil industry. If one solvent extraction plant is used for this purpose the value addition can be increased manifold from ₹ 39 to ₹ 665 through solvent extraction plant. There was no small scale industry for processing the byproduct such as broken rice in the existing model. But in case of proposed model the small scale industries give additional value addition of ₹ 410 per tonne of paddy. The value addition at retailer stage prices have increased from ₹ 950 for rice in existing model to ₹ 1220 in proposed model followed by rice bran refined oil value addition which can be enhanced from ₹ 9 to ₹ 40. Additionally the retailing value addition through ready to cook products will be added as extra to the worth of ₹ 80. To summarize the value addition in the existing value chain which was ₹ 5096 can be increase to ₹ 9530 through proposed model. Through the proposed model the value addition can be increased to the extent of 91.5 per cent.

CONCLUSION AND POLICY IMPLICATIONS

In value chain for rice production, the share in value addition was 26.42 per cent for rice millers, 0.16 per cent for RBCO, 0.09 per cent for RBRO, 0.05 for traders, 6.41 rice retailers and 0.04 per cent for rice bran refined oil retailers. In value chain for flaked rice industry, the share in value addition was 14.71, 0.28, 0.08, 0.09, 8.04 and 0.08 per cent for FRI, RBCO, RBRO, traders, flaked rice retailers and rice bran refined oil retailers in channel. However, the study revealed the possibilities of enhanced rice value chain, where the value addition can be enhanced from existing value addition of ₹ 5096 to ₹ 9530 per tonne of paddy through the proposed value chain model that will benefit all the stake holders of paddy value chain in the study area.

Policy Implications

The general value chain followed in the study districts reveals that, there is no much value addition at the farm level. In reality the value addition process begins from the rice miller, it has to be initiated from farm level like, production of high value rice variety, drying, storing etc, to increase the income of the rice farmers.

Value chain analysis is an effective source for market information. The information on the quality, variety, consumer preference etc, obtained from value chain studies has to reach all value chain actors to increase the benefits and efficiency of all stakeholders in rice value chain.

Quality is always important factor for preference of branded rice. Since the consumer are more health conscious, the rice millers have to focus on the quality aspect (such as less broken and policing) etc, to fulfill the consumer expectation.

Nowadays people are more health conscious and the consumers felt that rice bran oil is highly beneficial in day-to-day life. Hence there is need of more thrust and advertisement on the health benefit aspects of rice bran oil to attract more consumers, this will help the processors to scale up their production, in turn the cost of production would be reduced.

REFERENCES

Porter, 1985. Competitive Advantage-Creating and Sustaining Superior Performance. New York., The Free Press.

Kaplinsky., and Morris, 2001 .A Value Chain Analysis for the Srilankan Vegetables Subsector. The International Centre for Underutilized Crops.

Richard, J. and Asaph Besigye, 2005. Value Chain AnalysisMapping Maize, Sunflower and Cotton Chains. The United States Agency for International Development.

Stephen McCarthy, Deo Datt Singh and Hannah Schiff, 2008. Value Chain Analysis of Wheat and Rice in Uttar Pradesh, India. A Project Report Submitted to the USAID, ACDI and VOCA, Lucknow, India.

Dewasish Ghoshal, 2011. The Value Chain Analysis of Paddy in Andhra Pradesh. Post Graduate Diploma in Agricultural Management, NAARM, Hyderabad.

Sivapalan Achchuthan and Rajendran Kajananthan, 2012. A Study on Value Chain Analysis in Paddy Sector: Special Reference to Kilinochchi District, SriLanka. Global Journal of Management and Business Research, 12: 13-21.

Nagaraj, B.V. and Krishnegowda, Y.T. 2015. Value Chain Analysis for Derived Products from Paddy: A Case of Karnataka State. International Journal of Managing Value and Supply Chains, 6: 33-52.