Economic Affairs, Vol. 65, No. 2, pp. 249-254, June 2020

DOI: 10.46852/0424-2513.2.2020.17

Incidence and Determinants of Indebtedness of Agricultural Households in Gujarat

ABSTRACT

Amidst the scenario of distress among agrarian community it is very important to discuss farmers indebtedness. Most of the studies in India revealed that indebtedness of farm households is one of the crucial factors responsible for crisis. This paper examines the nature and determinants of farmer's indebtedness using unit record data from NSSO 70th round in Gujarat state. Incidence of indebtedness was studied using tabular and percentage analysis, while determinants were assessed using binomial logistic regression model. It was found that, the incidence of indebtedness was higher in agricultural households with large land holding size as compare to their counterparts with less land holding. Incidence was higher in non-SC/ST households than that of SC/ST households. There is ample scope for financial inclusion in South Eastern region of the state as non-institutional sources of credit were found more active. Households having cultivation as primary source of income were more likely to be indebted. MGNREGA job card holders also found more likely to become indebted. Thus, government should interfere in order to make hassle-free credit availability to the marginalized farm households for their livelihood security in the state.

Highlights

The present study made efforts to evaluate the incidence of indebtedness among various categories of agricultural households in order to bring in light the comparison in financial obligations among them. It may help the policymakers to relook in the credit advancement policies to make it better.

The present study made efforts to evaluate the incidence of indebtedness among various categories of agricultural households in order to bring in light the comparison in financial obligations among them. It may help the policymakers to relook in the credit advancement policies to make it better.

Keywords: Incidence of indebtedness, financial inclusion, institutional credit, marginalised farmer.

It has considerable importance in the discussion of the issues of farmers indebtedness. There is continuous credit needs by farmer for meeting there working capital needs. Hence timely and affordable credit provision to farm households plays crucial role in the betterment of agrarian community. Most of the studies shows that marginal and resource poor farmers have not much access to the formal credit network (Swain, 2001; Swain and Swain, 2007). Thus,in policy perspectives it is important to know the status of access to formal as well as informal credit system among various groups of farm households and farmer's financial commitments in long as well as short term periods. In this context, variation in regional estimates have also importance as resource distribution in various regions of different states is uneven and leads to distress. Economic status of the farm household is bettered reflected through the size of land holding rather than income or expenditure. Considering the same aspect, we examine incidence of indebtedness of farm households among various categories of land holding size. The evaluation also made among different social groups and primary source of income of farm households. Attempt was also made to study the probable factors responsible for indebtedness status of farm households.

How to cite this article: Thorat, V.S., Garde, Y. and Arhant, A. (2020). Incidence and determinants of indebtedness of agricultural households in Gujarat. Economic Affairs, 65(2): 249-254.

Source of Support: None; Conflict of Interest: None

The present study focused on various NSS regions of Gujarat state where regional disparities in resource distribution, per capita total expenditure and poverty is very high (Dubey, 2009). There are very limited studies performed in indebtedness of farm households particularly in Gujarat state. The study was carried out with dual objectives, first to study the incidence of indebtedness of agricultural households and second is to examine the various determinants that influence the status of agricultural households to be indebted.

METHODOLOGY

Data

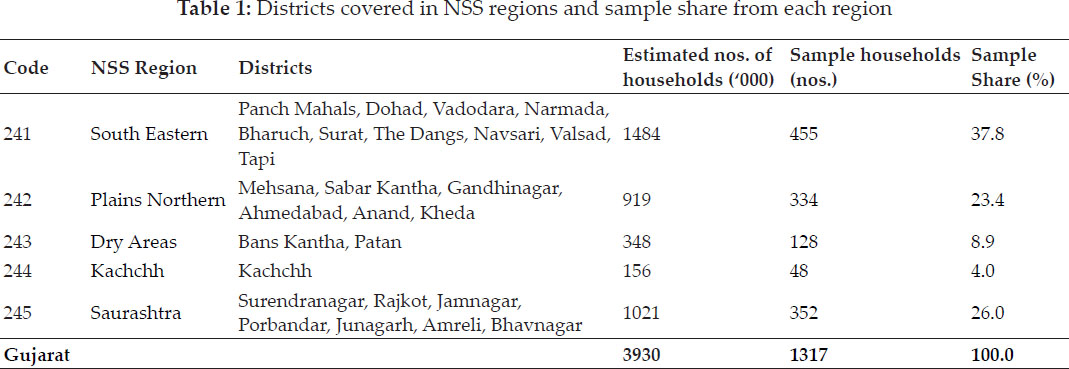

The study was based on secondary data available from National Sample Survey Organisation (NSSO) unit level data on Situation Assessment Survey of Agricultural Households 2012-13 collected under NSSO's 70th Survey Round. Data collected by NSSO focused on rural areas with stratified multistage random sampling and unit of sampling was rural agricultural household. The survey covered 1317 agricultural households in Gujarat in 5 NSS regions. The details of region wise sample and estimated agricultural households is as below:

Analytical tools

Data on incidence of indebtedness among agricultural households with different land holding size, social groups (ST, SC, OBC, Others) and primary source of income was analysed through tabular analysis and percentage approach. Binomial logit model was used to assess various determinant influencing on indebtedness situation of agricultural households. By interacting indebtedness status of household (binary dependent variable, indebted = 1, otherwise = 0) with fixed socio-economic characters of household, it was determined whether different types of households were more or less likely to be indebted.

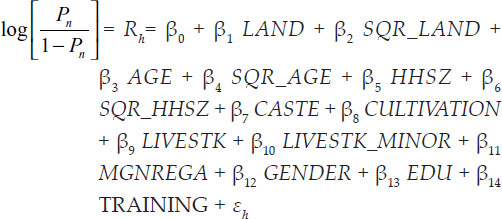

The logit model estimated was specified as below:

Where, Pn is the probability that a household is indebted, and where, 1-Pn is the probability that a household is not indebted. Rh is binary variable for indebtedness status of hth household (yes= 1, No= 0). The set of explanatory variables contain: LANDoperational size of landholding (hectares), AGE age of the head of the household (years), HHSZ household size (numbers), CASTE - social group status of household (1 for ST/SC, 0 for Non-SC/ST), CULTIVATION - household having cultivation as primary source of income, LIVESTK - household having livestock as primary source of income, LIVESTK_MINOR - household performing livestock as minor income source, MGNREGA - household having MGNREGA job card (yes = 1, No = 0),GENDER - gender of head of the household (1 for male, 0 otherwise), EDU - educational status of head of the household (1 for not-literate, 0 for literate), TRAINING - Household attended any professional training in agriculture (YES = 1, No = 0) and are logit coefficients and random disturbances, respectively.

The marginal effects were worked out to predict the effect of change in an explanatory variable on the probability of a household becoming indebted.

RESULTS AND DISCUSSION

Incidence of indebtedness (IoI)

The incidence of indebtedness was studied in four sections; firstly, across different land holding size, secondly across household having various primary source of income, thirdly across various social group and lastly across the agencies providing loans to the households (i.e. institutional and non-institutional).

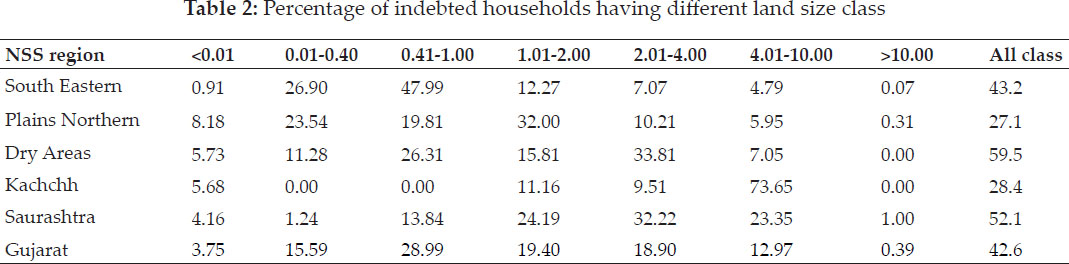

Incidence of indebtedness across different land holding size

An analysis of land size-wise indebtedness (institutional and non-institutional) revealed that the majority of households having land holding less than 2 hectares (68%) are indebted which declines with the increase in the land size that is; 19 per cent on households having land between 2 - 4 hectares, 13 per cent on households having land between 4 - 10 hectares and less than 0.5 per cent on large size of agricultural households in Gujarat. Incidence of indebtedness for marginal households belongs to South eastern region found higher as compare to other regions.

Incidence of indebtedness was more in the regions of Dry areas and Saurashtra as compare to other regions in Gujarat. Incidence was higher for small farners in Plains northern region. Table 2 shows that around 76% of total marginal farmers in South eastern region were indebted which was the highest in all the regions. About 32 % small farmers in Plains northern region found indebted whereas 34 % of total medium farmers in Dry areas region found indebted. Thus, the incidence of indebtedness was higher for marginal and small farmers in all the regions as compare to medium and large land holding categories.

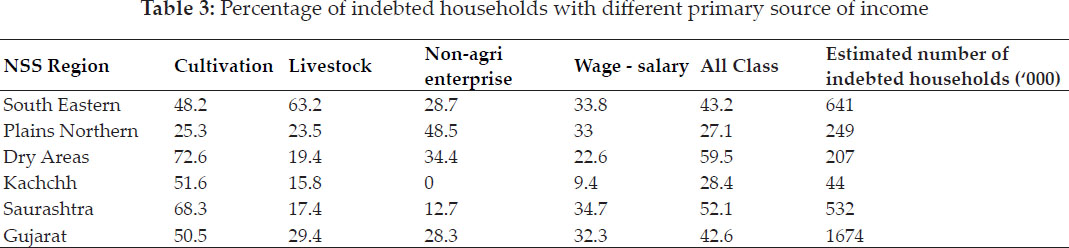

Incidence of indebtedness across household having various primary source of income

Incidence of indebtedness was also studied on the basis of various primary source of income. Table 3 shows that in state as a whole, half of the households having cultivation as a main source of income were indebted. This percentage was quite lower for households having livestock (29%) and non-agri. enterprise (28%) as primary source of income. Almost in all the regions except Plains northern, half of the agricultural households having cultivation as main income source were found indebted. Incidence is lower for the households having non-agri enterprise and wage - salary as primary source of income in most of the regions.

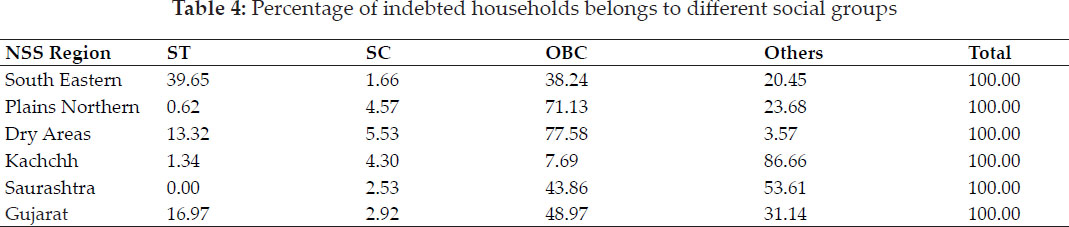

Incidence of indebtedness acrossvarious social group

An attempt was made to find out incidence of indebtedness among the households belongs to various social groups. Table 4 clearly shows that incidence was higher with non-ST/SC households as compare to ST/SC households. This may exist because of social discrimination in advancement of the loan and thus ST/SC households have less access to the credit. Regional estimates show that incidence was higher for ST households in South eastern region only. Incidence of indebtedness was very low in SC households as compare to all other in all the regions.

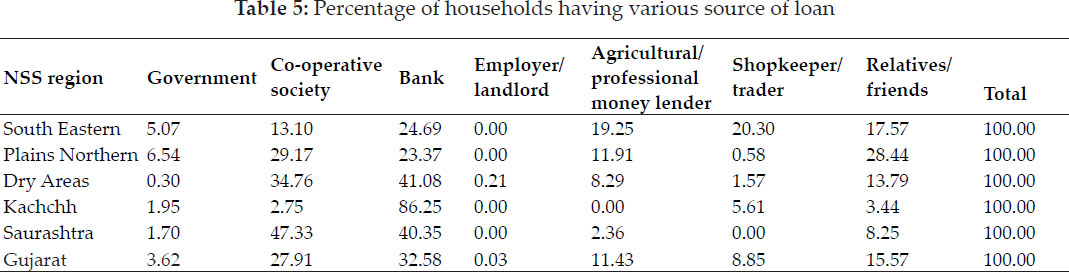

Incidence of indebtedness across the agencies providing loans to the households

It was very important to study the incidence of indebtedness on the basis of credit giving agencies in order to know the status of financial inclusion in the state. It was found (table 5) that around 64 % of agricultural households took loan from institutional sources like government, co-operative society and banks in the state. Still 36% loan was granted by non-institutional sources constituting 11% from agricultural and professional money lenders and 9% from shopkeeper and traders. Estimates shows that non-institutional sources are very prominent in South eastern region as around 58% households used them as credit source. This percentage is very low in Kachchh and Saurashtra regions as they depend on institutional credit agencies more than that of non-institutional agencies.

Determinants of indebtedness status

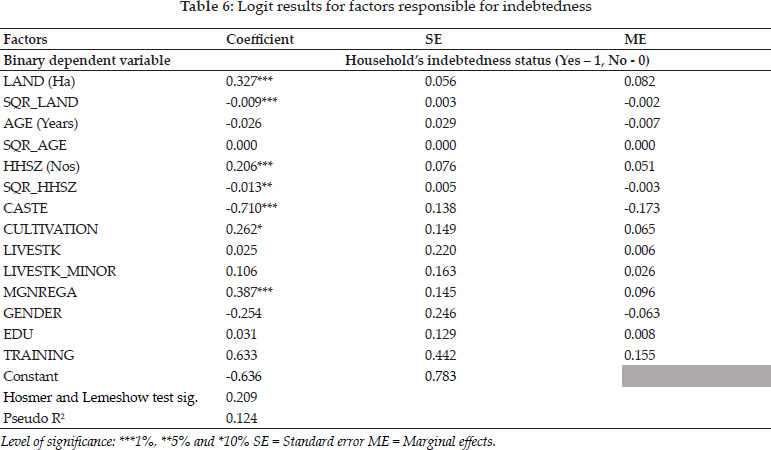

Household's indebtedness status may be an effect of various own socio-economic characters. Here those household having outstanding amount were considered as indented and otherwise as non-indebted. Need of credit may vary with socio-economic characters of household like possession of land, household size, social group status etc. Results of binary logit regression with indebtedness situation as dependent variables are presented in table 6.

It can be seen that, factors like size of total land possession, household size, social group status and household having MGNREGA job card had significant influence on the indebtedness. Other variables were not found significant. Size of land holding had positive influence on the indebtedness of household while its square had negative influence. It means as land size go on increasing, it reduces its positive effect on indebtedness situation. This may be because credit requirement beyond a certain limit is no more needed. Similarly, household size also has positive association with indebtedness situation as it shows more credit requirement to feed more members of the family. Negative relation of squared household size shows as members increases it may reduce the positive effect of household size in indebtedness. Estimates for social groups status shows that being ST/SC household reduce the likelihood of being indebted. It may because less access to credit system to the households. Households having MGNREGA job card had positive significance on indebtedness status. It shows the inability to pay off loans in time by the poor households bearing job cards.

In addition to this, table 6 also presents marginal effects (ME) of the variables which tell us that how changes in specific variables affect the probabilities of households reacting positively or negatively towards the indebtedness status. Marginal effects computed for continuous variables are not comparable with binary variables.

It shows that, increase a unit in total land possession may increase the probability of being indebted by 8% points. Similarly, a unit increase in household size may increase likelihood of being indebted by 5% points. The very influential factor found was social group status as it shows a unit increase in may reduce the chances of being indebted by 17% points. Further, if a household has MGNREGA job card, it may lower its chances of indebtedness by 9% points.

CONCLUSION

Results of incidence of indebtedness show that the agricultural households having large land holding size were more indebted as compare to their counterparts with less land holding. This may be because of the less access to the credit facility to marginal and small farmers in the state. Higher incidence with non-ST/SC households than ST/SC households shows that there is need of hassle-free availability of credit facility to ST/SC households in the state. Regional analysis shows that non- institutional sources had major role in advancement of credit in South Eastern region. It shows lack of financial inclusion in the region. MGNREGA, which is the assured employment generating programme at national level still have scope to improve the functioning in the state in sake of livelihood security of the marginalized farm households. Policy makers should concentrate on formation of policies enabling marginal and small farmers with better credit access and availability in all the regions of Gujarat.

REFERENCES

Dubey, A. 2009. Intra-State Disparities in Gujarat, Haryana, Kerala, Orissa and Punjab. Economic and Political Weekly. 44(26/27): 224-230.

NSSO. 2013. Situation Assessment Survey of Agricultural Households. National Sample Survey (NSS), 70th Round, 2012-13, National Sample Survey Office, New Delhi.

Rajeev, M. and Vani, B.P. 2011. Emerging from Shadow: New Dimensions of Household Indebtedness in India. VDM Verlag, Germany.

Shah, T., Gulati, A., Hemant P., Ganga S. and Jain, R.C. 2009. Secret of Gujarat's Agrarian Miracle after 2000. Economic and Political Weekly, 46(52): 45-55.

Swain, M. 2001. Rural Indebtedness and Usurious Interest Rates in Eastern India: Some Micro Evidence. Journal of Social and Economic Development, 3(1): 122-43.

Swain, M. and Swain, M. 2007. Rural Credit Market Imperfections in Drought Prone Bolangir District of Odisha: Some Critical Issues and Policy Options. Artha Vijnana, 49(3 & 4): 223-254.