Economic Affairs, Vol. 65, No. 4, pp. 581-587, December 2020

DOI: 10.46852/0424-2513.4.2020.14

Review Paper

The Asian Rice Sector at a Crossroads

ABSTRACT

This paper examined the trend in Asian rice production, role of rice in human nutrition and documents structure of rice market in major Asian Countries, by analyzing supply demand and trade scenarios for the fast five decades. Country wise data from FAOSTAT and WTO were collected for the past five decades, to analyze key issues related to rice sector with special focus on rice markets in Asia. Rice Area and production has been increased significantly at higher rate than the population growth rate in Asia over the past fifty years. This resulted in increase of per capita availability of rice and contributed significantly to nutrition security. However, there are wide imbalances in supply-demand across Asian countries .Thus rice trade has become a major global economic activity in the recent past. The structural changes in global rice markets are discussed in detail in the paper.

Highlights

Rice Area and production has been increased significantly at higher rate than the population growth rate in Asia.

Rice Area and production has been increased significantly at higher rate than the population growth rate in Asia.

There are wide imbalances in supply-demand across Asian countries.

There are wide imbalances in supply-demand across Asian countries.

The structural changes in global rice markets are discussed here.

The structural changes in global rice markets are discussed here.

Keywords: Rice production, Trade, Demand, Asia

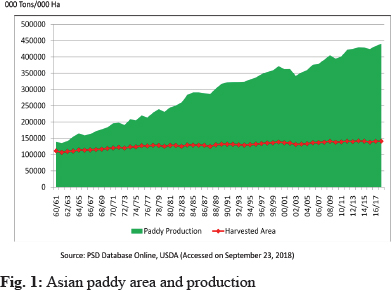

Rice is a staple for the majority of the 4 billion plus Asian population and a source of livelihood for millions of small and marginal rice farmers. In addition, rice is also deeply rooted in the rich traditions and cultures of many Asian countries, making it much more than just a staple food for the Asian population. The region cultivated rice on 141 million hectares and produced 440 million tons of milled rice in 2017/18 (Fig. 1), accounting for87% of global area and around 90% of global production. As shown in Fig. 1, current paddy production in the region is around 270% more than what it was at the start of the Green Revolution in the late 1960s vis-avis a harvested area increase of around 23% during the same period. In other words, the majority of the production growth in the past four decades has come from yield growth rather than area expansion. Within Asia, China and India are the top two rice-producing countries, accounting for more than half of the total global rice production. In 2017/18, both China and India produced 259 million tons of milled rice compared with global production of 492 million tons (PSD, USDA, Accessed on Sept 23, 2018). Apart from China and India, Asia is also home to other top rice producing countries including Indonesia, Bangladesh, Vietnam, Thailand and the Philippines accounting for 119 million tons of the remaining 233 million tons of global production. (Data source: Production, Supply and Distribution Database, USDA accessed on September 23, 2018).

How to cite this article: Mohanty, S., Baruah, S. and Janaiah, A. (2020). The Asian Rice Sector at a Crossroads. Economic Affairs, 65(4): 581–587.

Source of Support: None; Conflict of Interest: None

In other words, these seven Asian countries account for nearly 87% of the Asian production and around 76% of the total global rice production.

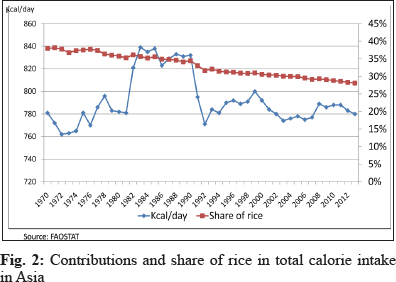

On the consumption side, rice is the most important staple food crop for the majority of Asian population with per capita consumption of 78 kilograms in 2013 (data source: FAOSTAT). Within Asia, per capita use of rice in Southeast Asia is the highest among all Asian regions (South Asia and East Asia). In 2013, per capita use of rice in Southeast Asia was around 130 kilograms compared with 76 kilograms in East Asia and 70 kilograms in South Asia (data source: FAOSTAT). Although the share of rice in total calorie intake has declined across Asia, it continues to remain the single most important food item in Asian food basket contributing more or less same calories now than what it did in 1970 (Fig. 2).

Changing Structure of Asian Rice Farming

Rice farming in Asia is dominated by millions of small farmers with an average landholding of 1 hectare. It is traditionally labor-intensive with labor costs accounting for 45% of the total cost of production and involvement of family members (Mohanty et al. 2015). Strong economic growth in the region in the past three decades have led to rapid outmigration of rural working population resulting in an increasing number of elderly and women to take charge of farming operation. For example, the average age of rice farmers in the Philippines increased from 44 in 1980 to 58 in 2011 while the average age of rice farmers in Bangladesh increased from 44 in 1988 to 51 in 2011.1 Women are primarily involved in crop establishment, harvesting, and post-harvest activities while men lead in preparing the land, managing the crop, operating farm machines, and marketing (Mohanty and Bhandari, 2014).

Apart from rural outmigration, rising nonfarm opportunities in rural areas that account for 40% of total rural employment are making agricultural labor shortages even more acute in Asia. The increasing labor scarcity has led to a rapid rise in wage rates in the past decade in almost all Asian rice-growing countries. The rate of increase accelerated after the mid-2000s for major rice-growing countries such as China, India, Bangladesh, Indonesia, and Vietnam. According to Steve Wiggins and Sharada Keats in their 2014 report on Rural Wages in Asia, the real wage rate in China increased by more than 90% between 2003 and 2007, by 35% for India between 2005-06 and 2012-13, and by 45% for Bangladesh between 2005 and 2010. Similarly, in Indonesia, the real agricultural wage rate in 2009 was 50% higher than what it was in the first half of the 2000s.

Labor shortages and rising agricultural wages are pushing farmers to explore appropriate mechanization of labor-intensive activities such as land preparation, transplanting, harvesting, and threshing to lower cost of production (Mohanty et al. 2015). Small-scale farm mechanization and custom-hiring arrangements with machines are fast evolving as viable solutions for smallholder rice farmers in Asia (Mohanty et al. 2015). Apart from male service providers, many women and youth are finding it attractive to enter the service provider business for land preparation, transplanting, and harvesting.

These service providers cover several hundred kilometers in a season, taking advantage of the differences in planting and harvesting period among different regions. In India, the service providers start from Punjab and Haryana in the northwest as they harvest their crop early. Then they move toward the southeast through Uttar Pradesh, Bihar, Odisha, and West Bengal, covering nearly 1,000 kilometers in a season. Similarly, combine harvest service providers in Thailand start from the Central Plain and move to northeastern Thailand, covering more than 800 kilometers in a couple of months (Mohanty et al. 2015).

1IRRI farm household database.

The rate of mechanization varies widely from country to country and among different rice-growing ecosystems within the same country. The extent of mechanization is much greater in the intensive production systems such as northwest and southern India, the Mekong Delta of Vietnam, and the Central Plain of Thailand than in the rainfed production systems of eastern India and northeastern Thailand (Mohanty et al. 2015). However, rising wage rates in unfavorable rice-growing regions are accelerating the pace of mechanization. It is just a matter of time before mechanization covers the majority of rice areas in Asia, particularly in land preparation, transplanting, harvesting, and threshing (Mohanty et al. 2015).

To offset the unviability of mechanization for smallholder farmers, several models of virtual land consolidation have started to emerge in different parts of Asia (Mohanty et al. 2017). The “Small Farmers, Large Field” (SFLF) model in Vietnam, which allows small farmers to benefit from economies of scale by pooling their small farms into large fields of 50–500 hectares to lower the per unit cost of using farm machinery, such as combine harvesters, is becoming popular among small farmers.

Similarly, an industrial rice farming scheme introduced by the Suphanburi Rice Millers Association in collaboration with Suphanburi Rice Research Center has convinced the farmers to grow one variety with synchronized planting and harvesting time on around 400 hectares (Mohanty et al. 2017). The idea is to lower the harvesting cost of US$90-100 per acre by 20–30% by providing service providers with a bigger contract for custom harvesting.

Small farmers in many parts of Asia are also renting additional lands that are available because of rural outmigration. With additional land coming through rental arrangement, Gagan Bihari Pradan, a small rice farmer in the eastern Indian state of Odisha featured in a Rice Today article (see A day in the life of an Odisha rice farmer on pages 40–41, Vol. 11, No. 4), now farms 2.5 hectares compared with 1 hectare in 2012. This allows farmers to modernize their farm operations through the use of mechanical transplanters, combine harvesters, dryers, threshers, etc.

The SFLF Pilot Experiment in Odisha

For the 2015/16 dry-season crop, a customized version of the SFLF model in Taraboisasan hamlet near Bhubaneswar, the capital of the eastern state of Odisha in India was piloted (Mohanty et al. 2017). 54 farmers with 84 acres participated in the pilot exercise. For more detailed description of the this experiment can be found in “Piloting the Vietnamese “Small Farmers, Large Field” scheme in Eastern India” published in January-March 2017 issue of Rice Today (http://ricetoday.irri.org/piloting-the-vietnamese-small-farmers-large-field-scheme-in-eastern-india/). The group decided to grow single variety and combined selected operations such as nursery management, mechanical transplanting, fertilizer purchase and combine harvest. Based on data collected from each participating farmer at the end of the season, the average per acre profit has been estimated to be ₹ 24,830 as compared to ₹ 12,130 in the 2015/16 dry season. Apart from the monetary benefits, farmers saved time and energy in each of the farming activities done together. As shown in Fig. 3, farmers also recognize the time they saved by having a group seedbed nursery, synchronized transplanting and harvesting and bulk fertilizer purchase since the fertilizer was delivered at their doorstep as compared to each of them purchasing fertilizer from retail outlet few kilometers away in past years (Mohanty et al. 2018).

Rice in Changing Consumption Pattern

As income grows in Asia, consumers will diversify their diet from staples to more high-value products such as meat, dairy products, fruits, and vegetables (Mohanty, 2015). In the recent past, there has been some decline in per capita consumption in mid-income Asian countries, but the rate of decline has been a lot slower than what we have witnessed in developed East Asian countries such as Japan, South Korea, and Taiwan. Even in an upper middle-income country such as Malaysia, per capita (kilogram per person per year) use has been flat for the past three decades at around 80 kilograms but, interestingly, per capita use has increased by more than 10 kilograms since the 2007 rice crisis. This is particularly true in Southeast Asia where rice consumption remains strong because of the absence of an alternative cereal, that is, wheat or maize, in people's diet.

Asian consumers are becoming more demanding on various quality traits including healthier rice such as low glycemic index for people with diabetes, rice with high dietary fiber and mineral, rice with high antioxidants, vitamin A-enriched rice, and many others (Mohanty, 2015). As consumers become more familiar with branding, some proportion of rice sales is expected to move from supermarkets to online trade.

As people adjust to the fast-paced life-style in cities, the preference for easier and more convenient cooking-food products will continue to rise in the future. This is already witnessed in Asia with rapid rise of packaged rice. India is leading the pack with more than 50% or 200 of the packaged rice product launches in Asia, followed by Vietnam and Thailand, which accounted for 10% and 8%, respectively, in 2012 (Mohanty, 2015). In India, the size of packaged rice market has increased by 66% between 2010 and 2012 from 1.2 million tons to 2 million tons (Mohanty et al. 2015). The acquisition of Tilda, the Indian basmati milling and export company, by the U.S. food group Hain Celestial, which is linking the Tilda brand with its existing distribution channel and bring basmati and ready-to-eat rice to the western world, is an example of market-driven rice value chain integration.

Changing Face of Asian Rice Market

In 2016, Asia exported more than 30 million tons of rice accounting for slightly more than three-fourth of the global trade (data source: FAOSTAT, 2017). The region has four of the top five exporters (Thailand, India, Vietnam and Pakistan) in the world accounting for 70% of the global rice trade. On the other side, it also includes some of the largest importers of rice in the region including China, Indonesia, the Philippines, Bangladesh, Malaysia, Iran, Iraq and Saudi Arabia.

In addition, there is a significant amount of informal cross-border trade among Southeast Asian countries and with China and many times this is not included in the published trade statistics. Around 2 million tons of rice are exported from Vietnam and Myanmar to China through cross-border trade (compiled from various media reports). Similarly, an estimated 600,000 tons of Cambodian paddy are exported to Thailand and Vietnam through informal cross-border exchanges. In addition, unofficial exports from Laos to Thailand and Vietnam are estimated be around 100,000 tons of rice, mostly in paddy form.

Since the price of rice is an important indicator of government performance in many Asian countries, it becomes imperative for policymakers to control rice trade flow in and out of countries for stabilization of the domestic rice market (Mohanty, 2015). In many cases state agencies are involved in taking part in importing/exporting rice through government-to-government (G2G) contracts (Mohanty, 2015). In Vietnam, the joint stock companies such as Vinafood1 and Vinafood2, for which the government is the major shareholder, act on behalf of the government to procure rice from the domestic market and sell it in the international market. Private traders are also active in Vietnam but they are relatively small in size and account for less than half of Vietnam's total exports (Hoang, 2014). During the period rice pledging schemes, Thai government was also involved in exporting rice held by the government. Similarly, the state trading agencies in large importing countries such as Indonesia and the Philippines are also heavily involved in the rice market for domestic price stabilization and food security. Private traders in these countries are sometimes allowed to fill a small share of the total import allotment. Similar to Indonesia and the Philippines, Malaysia strictly controls the import level through the state trading agency, which has monopoly power in importing rice into the country.

In case of basmati rice, the volume of trade has increased from 1 million tons to above 4 million tons in the past 15 years. Similar trend has also been witnessed in jasmine trade. y, with India capturing almost all the market expansion with Pakistan's market share declining from 50% to less than 20% during the same period (Mohanty 2015).

In case of jasmine rice market, Thailand used to dominate the market with almost 100% market share a decade ago but Vietnam and Cambodia have made significant in-roads into the market in recent years with Thailand market share dropping below 50% (Mohanty 2015). Vietnam has evolved as the biggest competitor for Thai Hommali jasmine rice with nearly 40% of the market share. Despite rising market share, Vietnamese jasmine still sells for a hefty discount in the market.

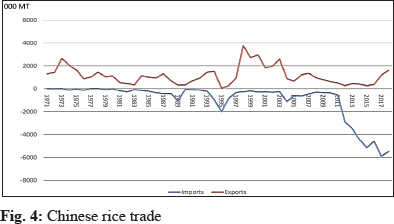

The changing consumption pattern is having significant impact on the structure of the Asian rice market. Take the example of China which has transformed from a rice self-sufficient country for decades to a growing net importer of rice in recent years (Fig. 4). China is now the largest importer of rice in the world with 5.9 million tons of imports in 2017 as compared to 0.575 million tons of imports in 2011(PSD, USDA, Accessed on September 23, 2018). Apart from price differences between China and neighboring rice growing countries because of rising cost of production in China, it appears that the demand for different types of rice such as sticky rice from Vietnam, jasmine rice from Thailand, and long-grain rice from Pakistan is growing as Chinese consumers diversify their consumption habit with rising income (Mohanty, 2015). During this period (2011-2018), Chinese stock level has more than doubled from 47 million tons in 2011 to 95 million tons in 2018 implying that rising imports were not due to domestic production shortfall. This is also further reinforced with rise in Chinese rice exports from negligible amount in 2011 to 1.8 million tons in 2018. Similar trend of simultaneous exports and imports of rice has also been witnessed in the U.S. for the past two decades as the consumers demanded different types of rice from different parts of the world. Throughout 70s and 80s, United States used to be a major exporter of rice with very negligible amount of imports. But imports started rising in early 90s to reach 0.855 million today in 2018 as compared to exports of 3.3 million tons

As the income grows in many other developing Asian countries, consumers are likely to demand different types of rice as they diversify their consumption basket as witnessed in China recently. Many Asian countries are likely to simultaneously export and import different types of rice as consumers diversify their diet and create demand for different types of rice. It is quite possible that rice exporting countries such as India, Thailand and Vietnam who imports very negligible amount will be importing rice in the future. For example, the Indian consumers might start consuming jasmine and japonica rice in the future prompting imports from Thailand and Vietnam (jasmine rice) and China, United States and Australia (japonica rice). Similar trend is also likely to be evident in importing countries who will be purchasing rice from larger group of exporting countries. For example, the Philippines might be purchasing basmati rice from India and Pakistan; jasmine rice from Thailand and Vietnam and Japonica from China, Australia and the United States in the future as compared to its majority of current imports sourced from Vietnam through G-to-G deals.

Opportunities for Improving Asian Rice Market

As the trend of simultaneous exports and imports of rice become widespread across Asian countries in response to changing consumption pattern, it may be less relevant for countries to pursue 100% self-sufficiency. Many national governments who are trying to achieve self-sufficiency and lesser dependence on foreign rice after 2007 rice crisis may need to reexamine their self-sufficiency goals keeping in mind the changing consumption pattern of their citizens. Each country has the right to pursue its national food security goal through various policy measures. But the policy measures need to take into account the changing consumption pattern otherwise the situation may evolve similar to what has been witnessed in China in the past few years where enough has been produced domestically to meet their need but the growing preference of Chinese consumers for other types of rice has made China the largest importer of rice and at the same time the domestically produced rice has gone into the government warehouse. It is important to note that Chinse imports were possible because the government allowed the foreign rice to come into the country.

At present, the Philippines policy makers are debating to convert quantitative import restriction to import tariffication. If this is approved by the policy makers, then it is likely that the imports will increase significantly from different sources as compared to majority of imports from Vietnam through G2G deal. It seems very probable that other Asian rice consuming countries are likely to relax their import regulations to allow different types of rice to enter into the domestic market to meet the growing demand for their citizens.

This is a welcome news for the functioning of the rice market. The flow of rice across borders and diversifying the import sources are likely to make the market less volatile to any supply shock. It will also create less panic among rice importers if there is production shortfall in one of their import sources. This is particularly comforting since rice production can fluctuate greatly from year to year, at the whim of nature. And, if climate change predictions are realized, extreme weather conditions will be more frequent, leading to shortfall in one or more countries.

This trend is likely to increase involvement of the private sector in rice trade which is particularly good for the functioning of the rice market. This is particularly true for Asia, in which the private sector plays second fiddle to state trading agencies in most rice-trading nations including Vietnam, Indonesia, Malaysia and the Philippines.

There is also likelihood of fringe exporters like Cambodia and Myanmar transforming into major players in the Asian market in the future. Both these countries have millions of hectares of fallow land that can be brought into rice production, but this will require enabling infrastructure and necessary policy support such as irrigation, farm roads, market linkages, storage, a port facility, and support for mechanization, seed sector development, and credit availability. Both these countries can export between 5 and 10 million tons of in the next 5–10 years providing buyers alternative source of imports contributing to the stability of the market.

CONCLUSION

Rice is the most important staple in Asia. The majority of Asian people eat rice two to three times a day, making it a very politically charged commodity in the region. The rising rural outmigration and urbanization are transforming the way rice is produced and consumed in Asia. Many new models of land consolidation are evolving across Asian rice growing countries to enable small farmers to mechanize and achieve economy of scale.

Similarly, the food basket of Asian consumers is also changing in response to income growth and urbanization. As the middle-class population grows in many Asian countries, it is likely to put pressure on countries to make different types of rice available in the market. Similar to what has been witnessed in China in recent years as simultaneous exporter and importer of different types of rice, other exporting countries are likely to face similar pressure. Similarly, importing countries are likely to expand their import sources to bring in different types of rice. This augurs well for the stability of Asian rice market in the future.

REFERENCES

Food and Agriculture Organization of the United Nations. 2011. The 2007–08 rice price crisis: How policies drove up prices and how they can stabilize the market. Economic and Social Perspectives Policy Brief 13.

FAOSTAT. 2017. Food and Agricultural Organization of the United Nations. Rome. Italy.

Hoang, H. 2014. Three Essays on Rice Markets and Policies in Southeast Asia with a Focus on Rice Consumption Patterns in Vietnam. Unpublished Doctoral Dissertation, University of Missouri-Columbia.

Mohanty, S. 2009. Global rice trade: What does it mean for future food security?. Rice Today, 8(2).

Mohanty, S. 2012. Rice self-sufficiency: the renewed mantra of domestic food security. Rice Today, 11(3).

Mohanty, S. 2015. Trends in Global Rice Trade. Rice Today, 14(1).

Mohanty, S. and Bhandari, H. 2014. Women Rising: Asian Rice Farming at a Crossroads. Rice Today, 13(4).

Mohanty, S., Bhandari, H., Mohapatra, V. and Baruah, S. 2015. The ongoing transformation of rice farming in Asia. Rice Today, 14(3).

Mohanty, S., Mohapatra, B., Baruah, S. and Prakashan, C. 2017. Piloting the Vietnamese Small Farmers, Large Field scheme in eastern India. Rice Today, 16(1).

Mohanty, S., Baruah, S. and Mohapatra, B. 2018. Validating the small-farmers, large-field concept to double income. Rice Today, 17(1).